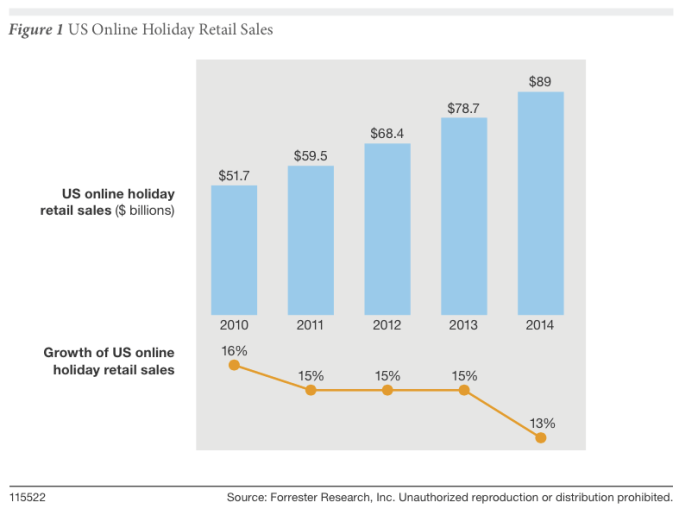

IBM saw huge mobile penetration, with 51.2% of all e-commerce in browsing, and 28.9% in sales contribution. Here is a trend on online sales trend over the past 5 years. It's interesting to observe that growth dipped after 3 years of flattening trend.

Some concern should be raised regarding actual Black Friday sales in the U.S., which were actually down -11% year over year. It seems that issues stemmed from Cyber Monday and shipping issues. Retailers should take note that a tight capacity management process and strategy are high imperative regarding package delivery network during the small window between Thanksgiving and Christmas.

Forrester has identified 3 key trends in U.S.:

– 3.4 million new online buyers. Note that actual number of new buyers is actually shrinking annually, due to loyal online behavior that are used to lower prices.

– More wallet share online. Average online buyer will spend 10% more online in 2014 than last year, due to comfort and trust of online shopping during holidays.

– Rise of mobile. ~213 million consumers are expected to have smartphones in 2014.iOS continues to dominate for browsing and buying. Screen size also matters. PC traffic still strong with sales making up ~3/4 of all online sales. Average order value of PC is higher than mobile, by about $16. ($112.81 on mobile devices.)Apple iOS users averaged $117.45 per order versus to $97.74 for Android users, and iOS sales accounted for 22.7% of total online sales, nearly four times that of Android at a mere 6% of all online sales. iOS traffic accounted for 35.4% of total online traffic, more than double that of Android at 15.4%.

So, with less new online buyers but more mobile activity, retailers shold take note of how to

- attract loyal customers without deeply discounting

- find ways to further draw a seamless PC to mobile to iPad experience (and make sure people are aware of these choices)

- pay attention to how US sales affect European markets aka re-evaluate the global holiday plan and strategy (very much tied to supply chain and delivery related issues)

- how to compete for a well-rounded annual figure that may not depend so heavily on one Black Friday as the week is now becoming diluted with sales all across the board

Source: http://techcrunch.com/2014/12/01/u-s-thanksgiving-black-friday-sales-break-1b-total-holiday-spend-online-will-be-89b/

No comments:

Post a Comment